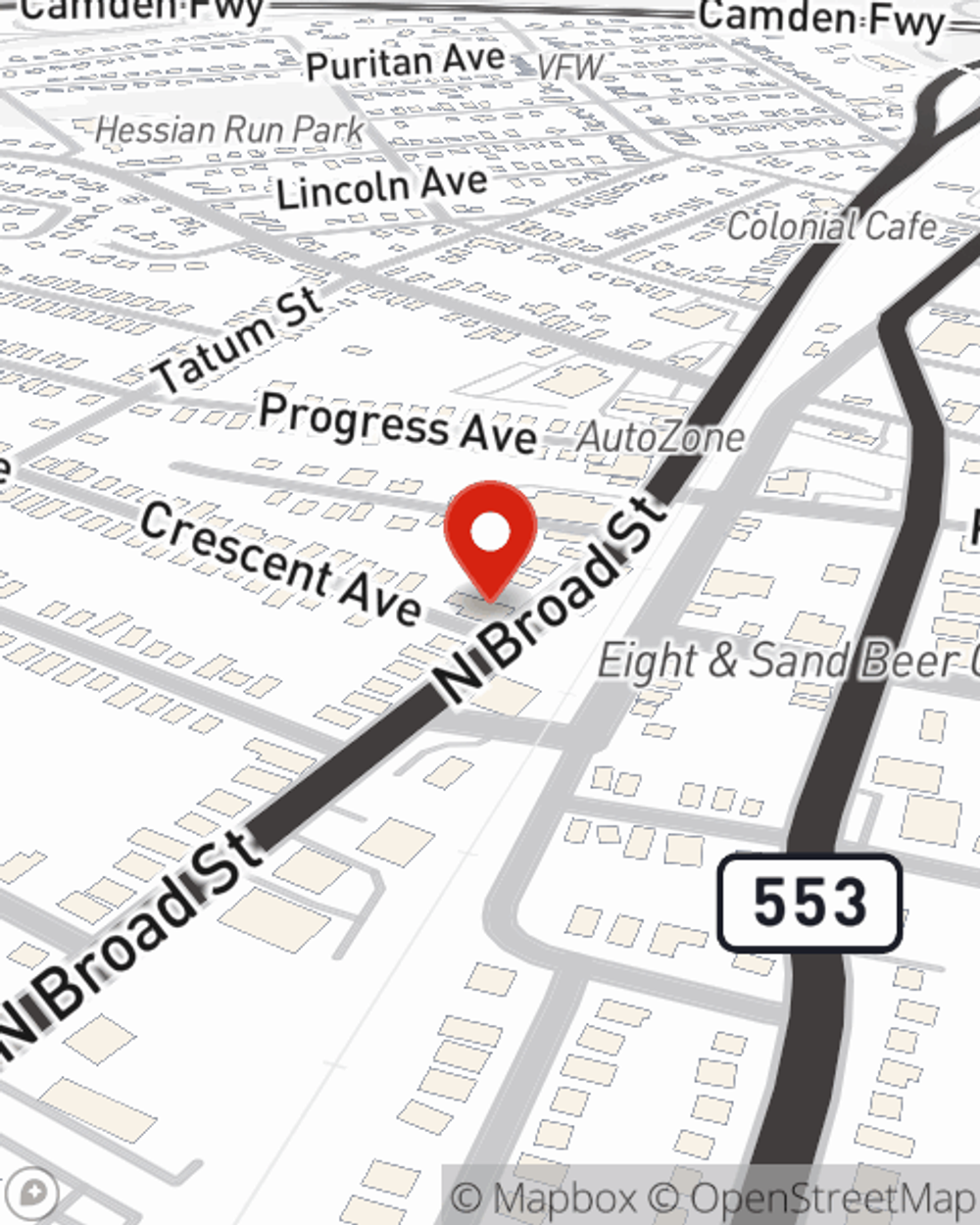

Renters Insurance in and around Woodbury

Looking for renters insurance in Woodbury?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

There's a lot to think about when it comes to renting a home - outdoor living space, size, number of bedrooms, condo or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Woodbury?

Renting a home? Insure what you own.

There's No Place Like Home

When the unanticipated theft happens to your rented home or townhome, often it affects your personal belongings, such as a TV, a tool set or a smartphone. That's where your renters insurance comes in. State Farm agent Kevin Coan has the knowledge needed to help you evaluate your risks so that you can protect your belongings.

Renters of Woodbury, State Farm is here for all your insurance needs. Contact agent Kevin Coan's office to learn more about choosing the right coverage options for your rented townhome.

Have More Questions About Renters Insurance?

Call Kevin at (856) 848-6660 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.